NRI Real Estate Investment

What We Do

We offer NRIs (Non-Resident Indians) an attractive gateway into Indian real estate through Fractional Ownership. Our platform allows you to invest in premium properties with lower capital, diversifying your portfolio with tangible assets and potentially high returns, ensuring a hassle-free investment experience.

With our transparent approach and high liquidity options, investing in India’s robust real estate market has never been easier. Invest and be part of India’s growth story from anywhere in the world.

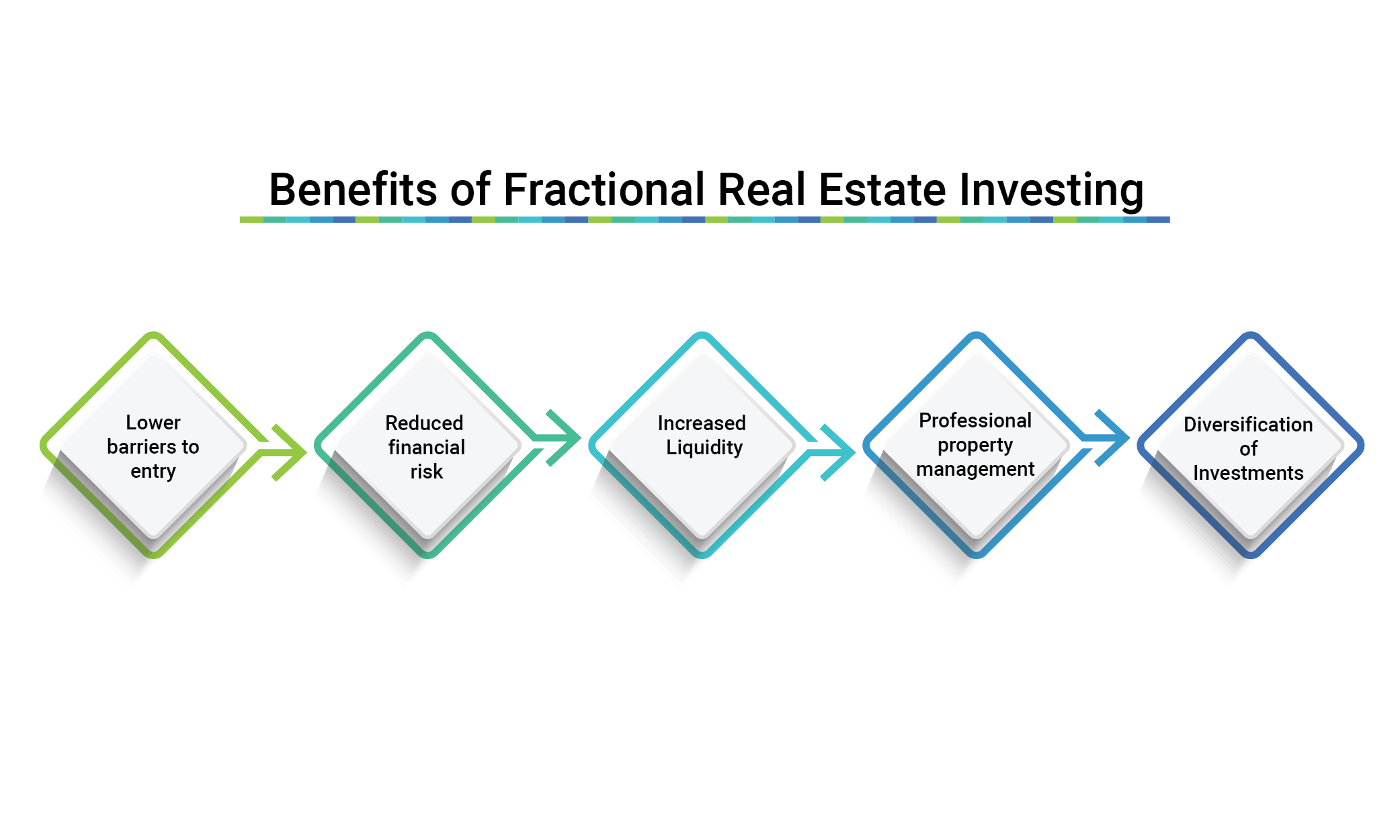

Benefits of Real Estate Investments for NRI

Overall, Indian real estate investments for NRI presents a compelling opportunity for NRI investors to earn stable long-term returns while hedging against risk through geographic diversification.

FAQs to Invest in Fractional Ownership – NRI

Blogs

Fractional Ownership over the counter in Real Estate

Here is a million-dollar question for wealth managers and advisers. Which OTC (over-the-counter) product in the Real Estate market has the largest leverage and why? At hBits, we know the answer. The answer is Fractional Ownership in the high-quality asset…

Commercial Realty| An Attractive Way To Build Wealth For NRIs

Commercial property has become one of the hottest investment assets for NRIs in the recent past. A rapidly developing economy, growing urbanization, the depreciation of the rupee, the establishment of RERA, which increases transparency in the realty sector, attractive rental yields, and

RBI's Rate Cut: A Boost for Investors & Why Fractional Ownership in Commercial Real Estate Stands Out

The Reserve Bank of India’s (RBI) latest Monetary Policy Committee (MPC) decision to cut the repo rate by 25 basis points (bps) to 6.25% marks a significant shift in the economic landscape.