Benefits of Fractional Real Estate Investing

27 Apr, 2023

Fractional real estate investing, or Fractional ownership, is the new Buzzword in the Indian real estate market, democratizing the way real estate investment is perceived in India.

In the post-coronavirus world, investors remain on the lookout for different avenues of investment. Apart from the traditional instruments like Gold, Fixed Deposits and government bonds, real estate remains a consistent favorite. Having proven to be a successful investment model in India, people are always looking out for real estate assets, especially commercial assets owing to better cash flows. However, unlike previous generations who were able to invest considerable savings in Gold and Land, today’s urbanites have been limited to investing in residential apartments or small plots.

Investing in quality Grade A real estate in India- so far - has required considerable money, connections and comprehensive knowledge, keeping the options open only to high net worth and ultra high net worth individuals. Not everyone has the cash on hand to buy a home or office, renovate or remodel, and then either rent it out or flip it. The commercial real estate space especially, has been a playground for large corporate entities and wealthy investors only- The high prices and complex investment process keeps retail investors from investing in big-ticket commercial real estate assets. Retail investors and middle-class investors were both hesitant and incapable of investing in large commercial projects.

For these investors, the only way to get into this market is through fractional real estate investing. With Fractional Ownership, retail investors can now invest small amounts to buy fractions of otherwise unaffordable yet highly profitable real estate.

Fractional property investment has emerged as a promising concept, owing to its low risk and high return properties serving as a boon for retail investors to make profitable investments that would provide long term capital appreciation as well as stable monthly return. Although Fractional Ownership of real estate has been in trend in the USA and Europe for a long time, this is picking up pace in India. The fractional ownership market in India is expected to grow 16% year-on-year and reach $ 3 Bn in the next few years.

Let us go into the finer details of this growing trend.

What is Fractional ownership in real estate?

Fractional Real Estate Investment is essentially partial Ownership in big-ticket size properties, jointly operated by a group of investors and pooled investment. These large properties do not otherwise fall under the investment potential of retail investors. The real estate management company invites retail inventors to invest a certain amount and take benefit from the high yields and capital appreciation

Fractional ownership in real estate gives you a stake in the real estate and makes you a part-owner. Let us understand this with an example. An asset management firm is managing a Grade A commercial property worth Rs 20 crore, leased to a large MNC. They invite 100 retail investors to invest Rs 20 lakh each and earn fixed monthly returns as well as capital appreciation at the time of exit, in proportion to their investment. This is fractional ownership.

The asset manager lists a range of such properties, as potential investments, on a tech enabled platform. The minimum ticket size for each investment is decided, and investors are invited to buy portions of the asset as per their capacity and risk appetite.

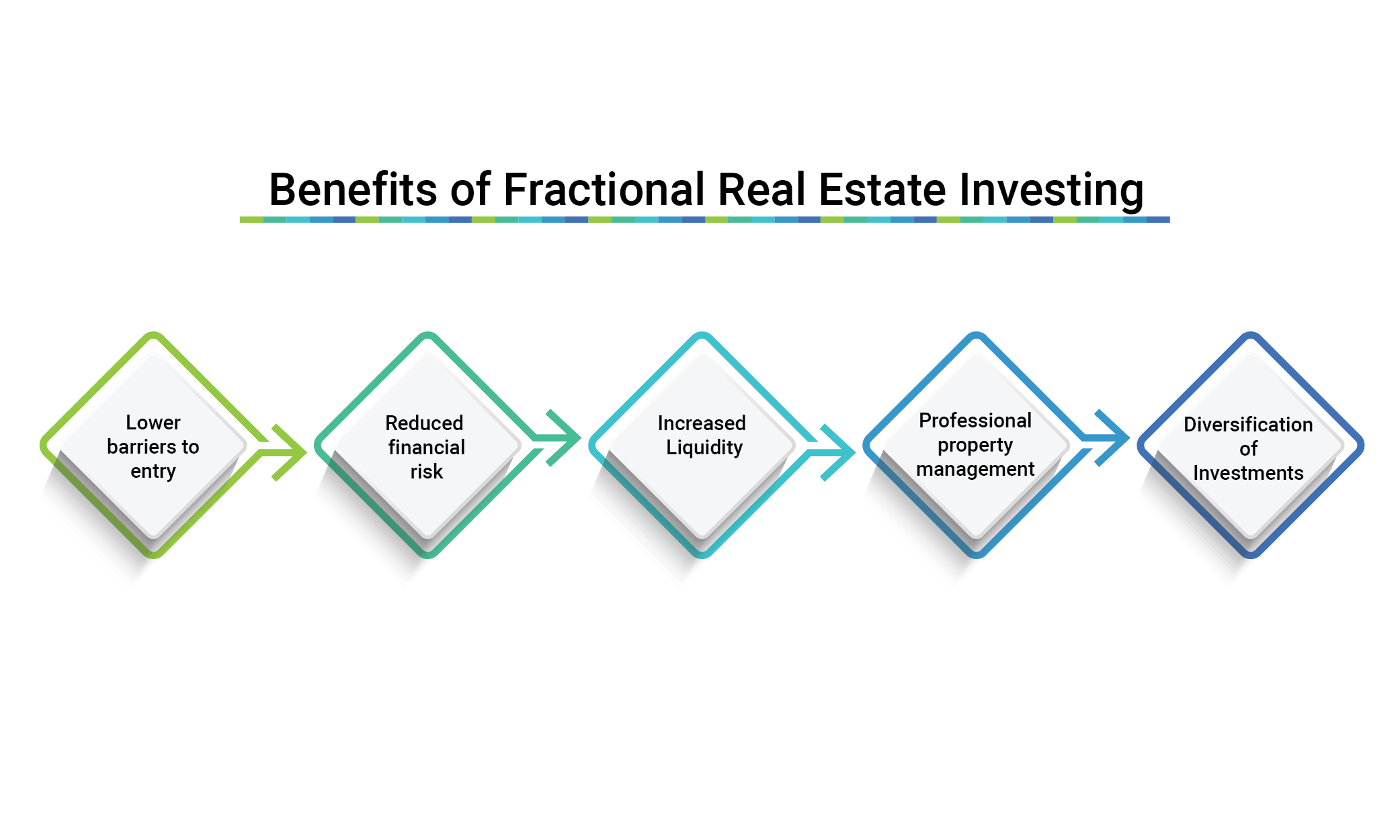

Benefits of fractional real estate investment

Despite being a comparatively new investment class in India, fractional ownership is a growth-oriented domain that is gaining traction and popularity. Some of the key benefits of fractional investment as an investment class are as follows:

1) Lower barriers to entry

Grade A real estate investment was previously an option only for the wealthy. By splitting the cost of an asset among various investors, fractional real estate investment significantly reduces the barriers to entry, allowing retail investors with a few lakhs to invest to gain access to high quality real estate.

2) Reduced financial risk:

By owning a smaller percentage of the property, fractional property investment reduces the financial risk for individual investors. If the property incurs losses, those losses are shared proportionally amongst the owners, minimizing the impact on any one investor

3) Increased Liquidity:

Fractional ownership in commercial real estate can provide increased liquidity as it can be easier to sell a fraction of a property than to sell an entire property. This allows investors to more easily exit their investment if needed.

4) Professional property management:

By pooling resources, fractional ownership can provide access to professional property management services, which can help reduce management costs and increase the overall value of the property

5) Diversification of Investments:

Fractional ownership can provide investors with the opportunity to diversify their investments, spreading risk across multiple properties and reducing concentration risk. Investors can make multiple small investment across different types of This can help to mitigate the potential losses that might result from a downturn in any one particular sector or region of the market

Drawbacks Of Fractional Property Investment

Like any investment, fractional property investment has its downsides too.

Harder to finance/ raise debt

Financing an asset with many investors isn’t the same as financing a single-family home. Mortgages are usually made for one or two people, not many. Fractional investment is easiest when you buy the property outright in cash, but may present complications for people trying to rasie debt to invest in real estate.

Potentially unknown co-owners

If you’re using a fractional real estate company to facilitate the purchase and manage the property, you’re probably getting into it with many buyers who you don’t know. That could create headaches down the road if disputes arise.

Understanding the Cost Structure

If you’re having a manager operate the fractional property, you’ll want to understand how much you’re paying and what potential fees you’ll be liable for. Even if this is more of a financial transaction and you own shares, you’ll need to understand what the fee structure is. It’s not unusual for an asset manager to take a 1 percent cut on the sale or disposition of a property, and you may also be charged for ongoing management of those assets, depending on the arrangement.

It’s vital that you understand the fees and what you’ll have to pay. And while you’re at it, you’ll want to investigate how you can exit the investment and the fees associated with that.

Less control

One of the perks of buying your own property is deciding what is best for yourself. When you share that property with other people, you lose out on some of that control. The more shareholders or owners are in the mix, the less say you get in how a property is managed.

Who should invest in Fractional Property?

Fractional real estate investment is best for:

- Those looking to break into real estate investing: If you want to get your foot in the door with a little bit of cash and not a ton of experience, fractional property investment might be a good idea.

- Buyers looking for a non-primary property: Buying a home with other people means you split ownership. Only go this route if you don’t plan to live in the home.

- Investors who have done their homework: Scour different fractional real estate investing sites to see which ones have insight into the neighborhoods and locations you’re exploring. Some of these fractional real estate startups are based in specific cities or regions, which might limit where you can buy. Even if there’s a lower barrier to entry, you can still do your due diligence and find the best company to go with before you buy. In some cases, you might invest fractionally without the help of a company.

Bottom line

Fractional real estate investing is one way to boost your passive income and break into real estate investing. It’s a great option for investors with limited funds who don’t want the burden of owning and maintaining an extra property, but it does come with work. Before you fully dive in, calculate the possible returns to make sure you’re maximizing your investment potential.

Frequently Asked Questions

Q1. Is fractional ownership legal in India?

Ans. Fractional ownership is legal in India. Real estate developers offer it, allowing multiple investors to own a portion of a property. It enables investment without bearing the full cost and offers flexibility and liquidity.

Q2. How does fractional ownership in real estate work?

Ans. In Fractional ownership multiple investors pool their funds to purchase a property. Each investor owns a percentage share of the fractional property proportional to their contribution.

Q3. Is fractional investment worth it?

Ans. Fractional investment can be worth it for investors looking to diversify their portfolio and invest in real estate without committing a significant amount of capital.

Q4. Is fractional real estate investing risky?

Ans. Fractional real estate investing can carry risks, just like any other investment. It is essential to do your research and understand the potential risks involved before investing in fractional real estate.