Increase in Office Leasing Y-O-Y Since 202240%

Upto

18%

IRRUpto

10%

Rental YieldWhat process does hBits follow when acquiring a asset?Know More

What is

Pre-Leased Property?

Pre-leased properties are commercial or residential spaces bought from developers with a rental agreement already in place. This innovative investment model allows you to own a property that is immediately income-generating, courtesy of existing tenants. Popular in India’s thriving real estate market, these properties serve as a beacon for investors seeking stable, immediate returns without the wait or hassle of finding renters.Why Choose

Pre-leased Properties?

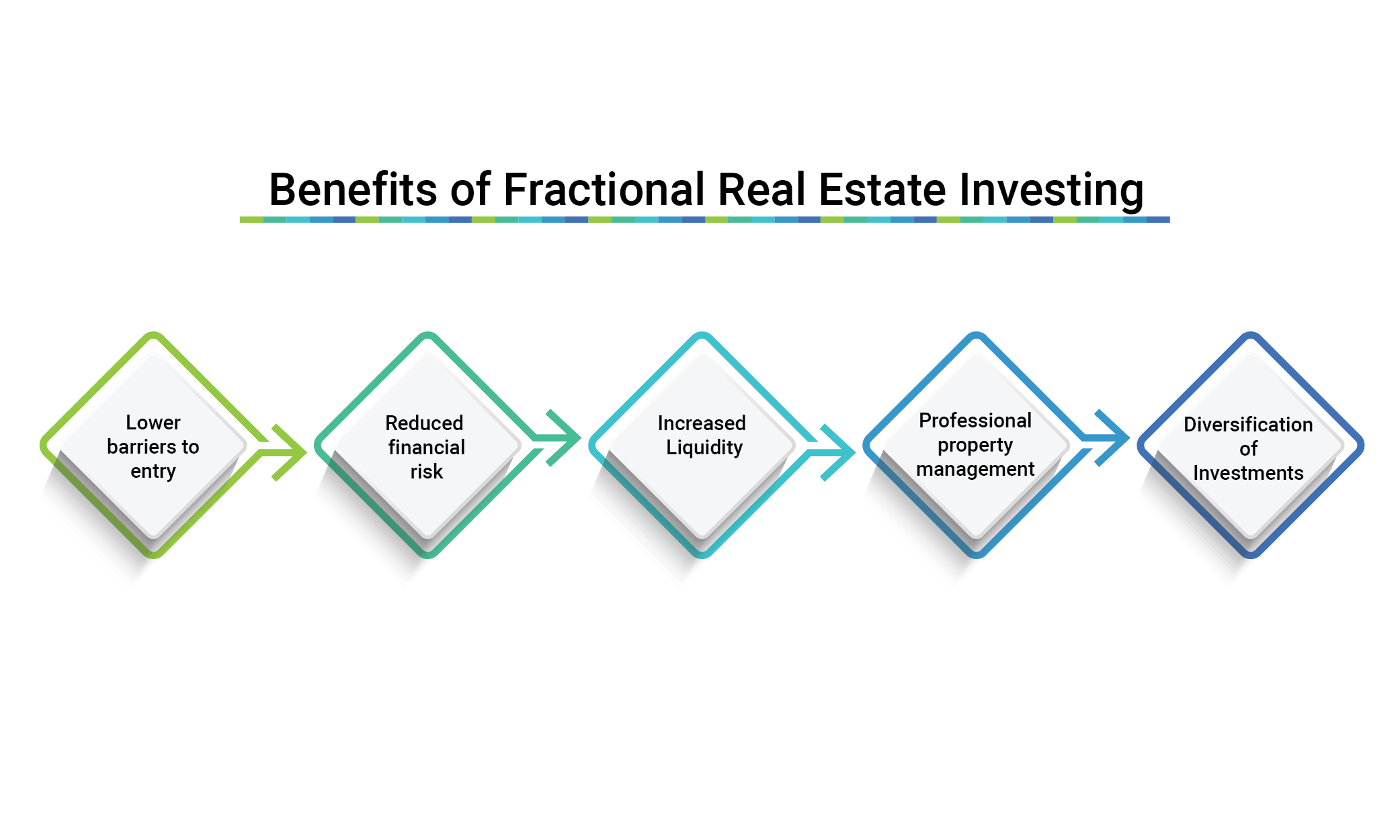

Investing in pre-leased properties offers a strategic advantage by providing a secure and immediate revenue stream. This approach not only guarantees a steady cash flow from the outset but also mitigates the risks associated with vacancy and tenant acquisition. It’s a smart choice for those looking to diversify their portfolio with minimal risk and maximum efficiency.Unveiling the Benefits

Immediate Returns

Start earning from day one with pre-secured rental income.

Lower Risk

The pre-tenancy reduces vacancy risks and ensures financial stability.

Capital Appreciation

Benefit from both regular income and potential property value increases over time.

Quality Tenants

Typically, these properties attract reputable businesses and renters, promising long-term leases, and reliability.

Paving Our Path

with Expertise

Our journey is carved with deep market knowledge, technology-driven solutions, and an unwavering commitment to excellence. We guide you through the complexities of investing in pre-leased properties, ensuring a seamless and rewarding experience. With a keen eye for promising opportunities and a dedication to your investment success, we are not just your advisors; we are your partners in paving the way to a prosperous future.Blogs

View all blogs

Fractional Ownership over the counter in Real Estate

Here is a million-dollar question for wealth managers and advisers. Which OTC (over-the-counter) product in the Real Estate market has the largest leverage and why? At hBits, we know the answer. The answer is Fractional Ownership in the high-quality asset…

Commercial Realty| An Attractive Way To Build Wealth For NRIs

Commercial property has become one of the hottest investment assets for NRIs in the recent past. A rapidly developing economy, growing urbanization, the depreciation of the rupee, the establishment of RERA, which increases transparency in the realty sector, attractive rental yields, and

RBI's Rate Cut: A Boost for Investors & Why Fractional Ownership in Commercial Real Estate Stands Out

The Reserve Bank of India’s (RBI) latest Monetary Policy Committee (MPC) decision to cut the repo rate by 25 basis points (bps) to 6.25% marks a significant shift in the economic landscape.