Commercial Real Estate in India

Commercial Real Estate is more lucrative when it comes to earning rental yields.

What is Commercial Real estate?

Commercial real estate encompasses properties used for business purposes, such as office buildings, retail spaces, industrial warehouses, hotels, and multifamily apartment buildings. These properties are leased to businesses and organizations, offering a distinct advantage over residential real estate, where tenants are individuals or families. Investing in commercial real estate is attractive for investors seeking higher rental yields and more stable cash flows. The longer lease terms associated with commercial properties contribute to this stability and predictability in income. Furthermore, the potential for capital appreciation over time adds to the appeal of commercial real estate investments. Factors like economic growth, development in the surrounding area, and property improvements can increase the value of these investments.For investors willing to research and understand the market, commercial real estate presents a valuable opportunity. Identifying properties with strong potential for rental income and appreciation, while managing risks, can lead to lucrative investment outcomes.Factor to look while investing in Commercial Real Estate

Market Potential Assessment

Before diving into commercial real estate, it’s crucial to size up the market and location. Look for bustling business areas with steady demand, ensuring reliable tenants and secure lease agreements.Tenant Business Analysis

Get to know your potential tenants and their businesses inside out. Identify any risks that could impact rental income, especially in sectors prone to disruptions like online competition.Tenant Management Evaluation

Take a close look at how tenants are managed. Opt for properties hosting businesses with solid management and governance, ensuring smooth operations and timely payments.Permissions and Clearances Understanding

Understand the red tape involved in commercial property investments. Map out the permissions needed and their timelines to gauge the investment’s feasibility and your patience level.Employment Trends Consideration

Stay ahead of employment trends that could affect commercial property demand. Factor in shifts like remote work preferences to adapt your investment strategy and mitigate risks.Partner Selection

Choose partners wisely for commercial property ventures. Look for reputable collaborators with financial stability and industry experience to share the load and increase your chances of success.Why one should invest in CRE

Process of Acquiring an Asset

SOURCING

Sourcing from developers, International Property Consultants, and local brokers.

EVALUATION

Appraising assets, their ROI, profiling tenants, and reviewing lease agreements.

ANALYSIS

Sourcing from developers, International Property Consultants, and local brokers.

DUE DILIGENCE

Sourcing from developers, International Property Consultants, and local brokers.

TOMORROW

Completely Automated

SOURCING

Inbound sourcing given scale and historic performance.

EVALUATION

An automated process that runs on an algorithm check list.

ANALYSIS

Data-driven predictive analytics to forecast future prices.

DUE DILIGENCE

Automated interactions with law firms for legal processes.

SOURCING

Sourcing from developers, International Property Consultants, and local brokers.

SOURCING

Inbound sourcing given scale and historic performance.

EVALUATION

Appraising assets, their ROI, profiling tenants, and reviewing lease agreements.

EVALUATION

An automated process that runs on an algorithm check list.

ANALYSIS

Sourcing from developers, International Property Consultants, and local brokers.

ANALYSIS

Data-driven predictive analytics to forecast future prices.

DUE DILIGENCE

Sourcing from developers, International Property Consultants, and local brokers.

DUE DILIGENCE

Automated interactions with law firms for legal processes.

TODAY

Robust Asset Selection

SOURCING

Sourcing from developers, International Property Consultants, and local brokers.

EVALUATION

Appraising assets, their ROI, profiling tenants, and reviewing lease agreements.

ANALYSIS

Sourcing from developers, International Property Consultants, and local brokers.

DUE DILIGENCE

Sourcing from developers, International Property Consultants, and local brokers.

TOMORROW

Completely Automated

SOURCING

Inbound sourcing given scale and historic performance.

EVALUATION

An automated process that runs on an algorithm check list.

ANALYSIS

Data-driven predictive analytics to forecast future prices.

DUE DILIGENCE

Automated interactions with law firms for legal processes.

SOURCING

Sourcing from developers, International Property Consultants, and local brokers.

SOURCING

Inbound sourcing given scale and historic performance.

EVALUATION

Appraising assets, their ROI, profiling tenants, and reviewing lease agreements.

EVALUATION

An automated process that runs on an algorithm check list.

ANALYSIS

Sourcing from developers, International Property Consultants, and local brokers.

ANALYSIS

Data-driven predictive analytics to forecast future prices.

DUE DILIGENCE

Sourcing from developers, International Property Consultants, and local brokers.

DUE DILIGENCE

Automated interactions with law firms for legal processes.

Know More About

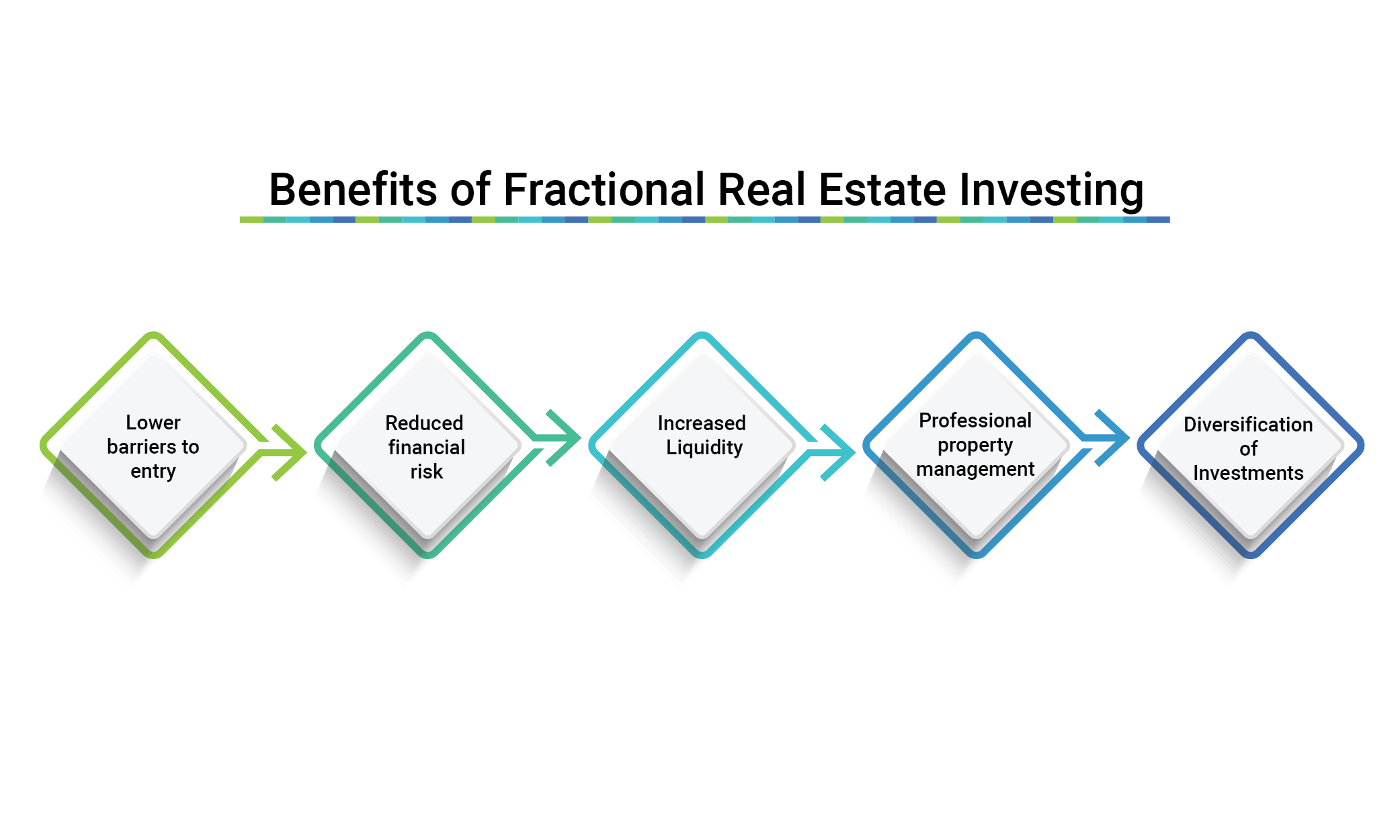

Fractional Ownership Investment

Blogs

Fractional Ownership over the counter in Real Estate

Here is a million-dollar question for wealth managers and advisers. Which OTC (over-the-counter) product in the Real Estate market has the largest leverage and why? At hBits, we know the answer. The answer is Fractional Ownership in the high-quality asset…

Commercial Realty| An Attractive Way To Build Wealth For NRIs

Commercial property has become one of the hottest investment assets for NRIs in the recent past. A rapidly developing economy, growing urbanization, the depreciation of the rupee, the establishment of RERA, which increases transparency in the realty sector, attractive rental yields, and

RBI's Rate Cut: A Boost for Investors & Why Fractional Ownership in Commercial Real Estate Stands Out

The Reserve Bank of India’s (RBI) latest Monetary Policy Committee (MPC) decision to cut the repo rate by 25 basis points (bps) to 6.25% marks a significant shift in the economic landscape.